vermont state tax exempt form

You may claim a tax credit for a vehicle registered to you for a period of 3 years or more in a jurisdiction that imposes a state sales or use tax on vehicles. Centrally Billed Account CBA cards are exempt from state taxes in EVERY state.

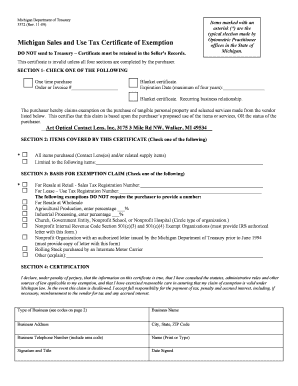

Printable Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Dental- Vermont Sales Tax Exemption Certificate for Purchases of Toothbrushes Floss and Similar Items of Nominal Value to be Given to Patients for Treatment.

. A previous Vermont or out-of-state title indicating the applicants ownership. The state of Vermont provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. This means aspirin is exempt whether the purchaser uses the drug.

Do I need a form. Vermont Department of Health Created Date. Forms By Tax or Type All Forms and Instructions Personal Income Tax Corporate and Business Income Taxes Property Tax.

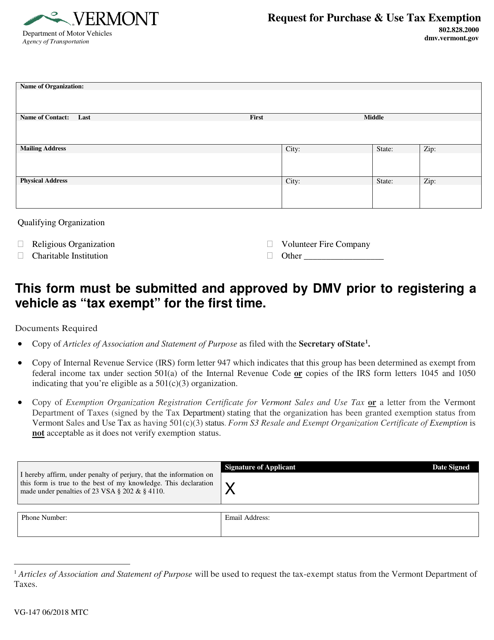

How To Apply. Copies of the IRS form letters 1045 and 1050 indicating that youre eligible as a 501c3 organization. Of the conditions outlined on this form must be met to qualify for a tax exemptionIf not tax is due at time of registration andor title.

Sign and date the form. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000. Tangible personal property in this category is exempt from sales tax regardless of who purchases the product or how it will be used.

802 828-5932 PLEASE DO NOT SEND APPLICATION MULTIPLE TIMES 4. Mail or fax the form along with the required documentation see below to the Vermont State Office of Veterans Affairs for the exemption to apply. Vermont law exempts federal and state credit unions from some state taxes except for state and municipal property taxes and personal property taxes.

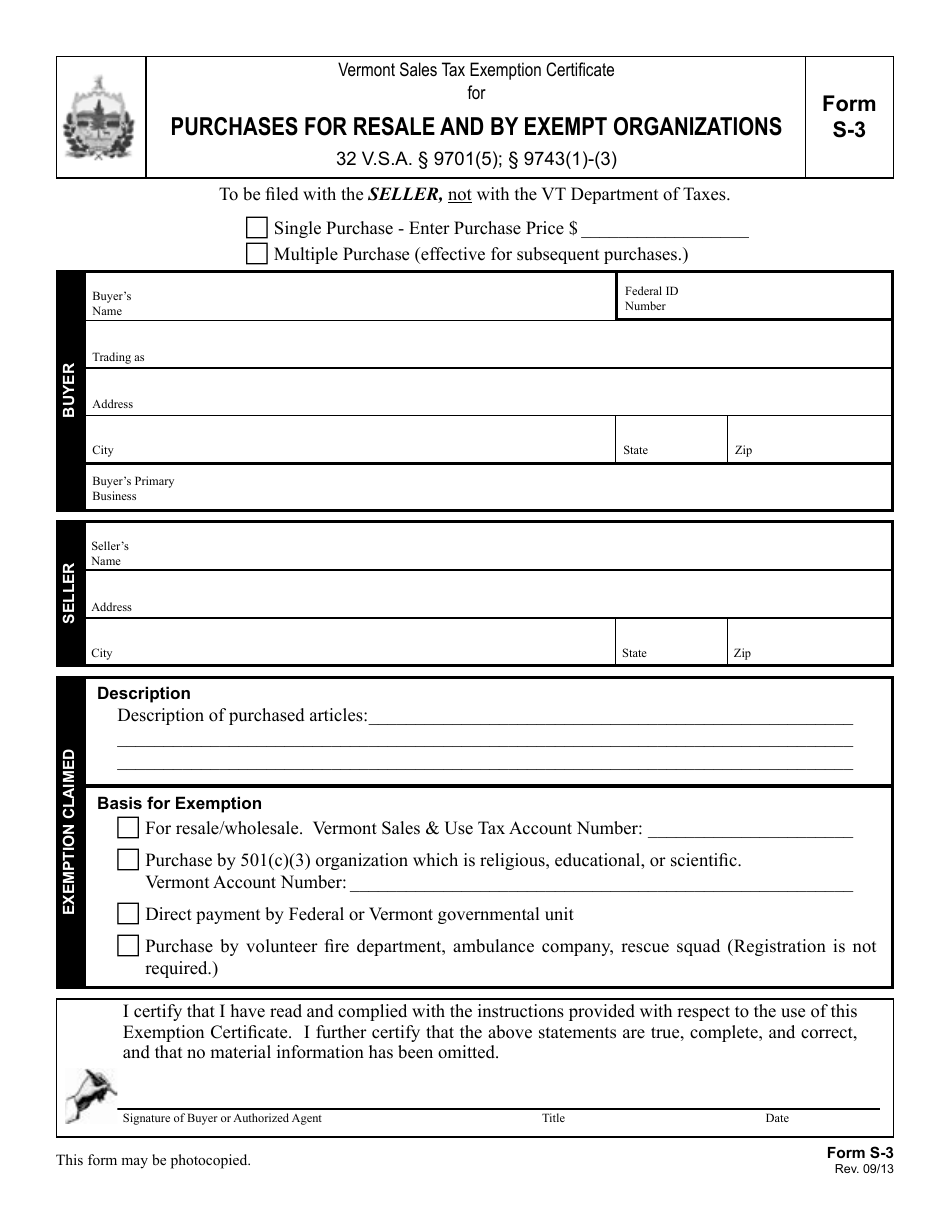

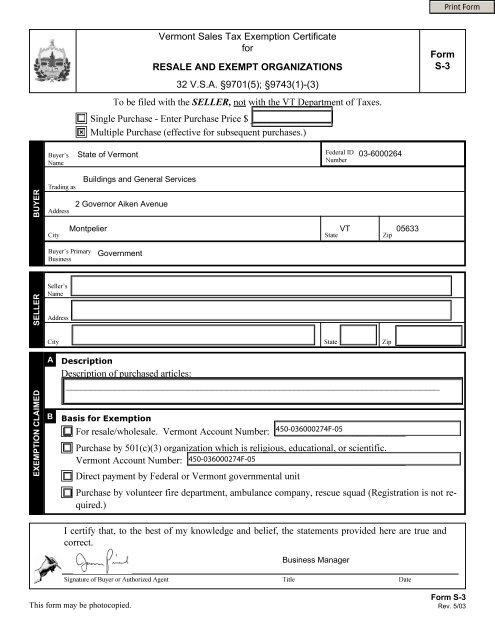

Copy of Internal Revenue Service IRSform letter 947 which indicates that this group has been determined as exempt from federal income tax under section 501a of the Internal Revenue Code. Annual Reports and Filings for Nonprofits in Vermont. Steps for filling out the S-3 Vermont Certificate of Exemption.

Limited items are exempt from sales tax. An original or a certified copy of a previous Vermont or out-of-state registration indicating the applicants ownership. Registration Tax Title Form form VD-119.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. The exemption reduces the appraised value of the home prior to the assessment of taxes. Do I need a form.

The veterans home will be taxed. S tep 2 Check whether the certificate is for a single purchase or multiple purchases. Ad Download Or Email Form S-3C More Fillable Forms.

Exemptions Under the Public Records Act all public records are open to public inspection or copying unless specifically exempted by law. 280 State Drive Waterbury Vermont 05671-1010 Phone. Go to myVTax for more information.

Line-by-line instructions for complex tax forms can be found next to the file. South Carolina SC x No Exemption based on the status of the purchaser. Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt.

503 ˇ ˆ SELLER ˇ BUYER ˇ ˇ ˆ ˇ. SF1094 United States Tax Exemption Form. You may complete Form PVR-317 Vermont Property Tax Public Pious or Charitable Exemption application to.

Fact Sheets and Guides. An item is exempt from tax based on the product type or category. You will be required to prove that the vehicle was registered in a qualifying jurisdiction.

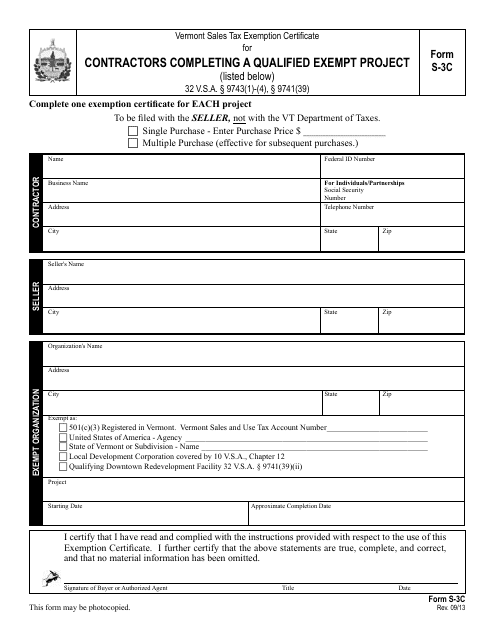

All filings must be completed online. ˇ ˆ Form S-3C Rev. Forms and Publications Forms and Publications File your return electronically for a faster refund.

Form S-3F Vermont Sales Tax Exemption Certificate For Fuel or Electricity 24383 KB File Format. Vermont Secretary of State. Vermont Sales Tax Exemption Certificate for Fuel or Electricity.

If the retailer is expected to be purchasing items frequently from the seller instead of completing a resale. GSA-FAR 48 CFR 53229. The tax is computed by multiplying the NADA average trade-in value of the vehicle or the purchase price whichever is greater on the date of registrationtitle by the current tax rate.

United States Tax Exemption Form. Form S3 Resale and Exempt Organization Certificate of Exemption is not. An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale.

This statute is also where public agency and public record are defined. 317 but many exemptions also exist outside of 1 VSA. The veterans town provides a 20000 exemption.

ˇ ˆ Form S-3 Rev. You will be required to submit a completed Certification of Tax Exemption form VT-014 Vehicles previously registered out-of-state. Sales and Use Tax.

Present sales use tax exemption form for exemption from state hotel tax. Tennessee TN Exempt from Sales and Use tax. To pay by paper check select I Want to Print Mail With Check at the bottom of the eCheck payment screen.

Vermont Sales Tax Exemption Certificate for Manufacturing Publishing Research Development or Packaging. An eligible veteran lives in a home valued at 200000. 118 State Street Montpelier VT 05620-4401 or Fax.

A core set of these exempt records are outlined in 1 VSA. Your town lister makes the initial determination of whether a property is exempt from tax under the law. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

South Dakota SD No reciprocity with State of Vermont per 1-800-TAX-9188. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Wednesday June 16 2021.

Step 1 Begin by downloading the Vermont Certificate of Exemption Form S-3. SF1094-15cpdf PDF - 1 MB PDF versions of. The applicant must furnish one of the following proofs of ownership in order of preference.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. For example drugs intended for human consumption is a product-based exemption. Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and.

Choose a link below to begin downloading. GSA-FAR 48 CFR 53229. A previous Vermont or out-of-state title indicating the applicants ownership.

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

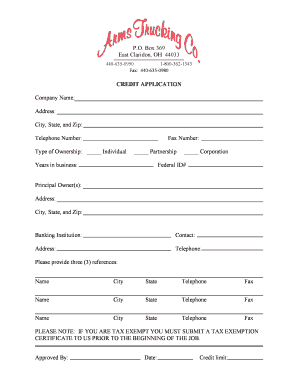

Trucking Company Sales Tax Exemption Form Fill Online Printable Fillable Blank Pdffiller

Buying Or Selling Ensure A Smooth Transaction By Hiring A Real Estate Attorney Massachusettsrealestate N New Hampshire Real Estate House Styles Real Estate

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

Printable Vermont Sales Tax Exemption Certificates

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Application For Sales Tax Exemption Rev 72 Pdf Fpdf Doc Docx Pennsylvania

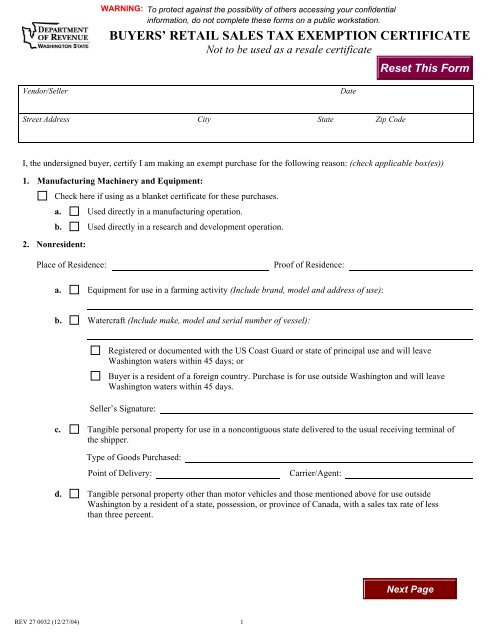

Buyers Retail Sales Tax Exemption Certificate

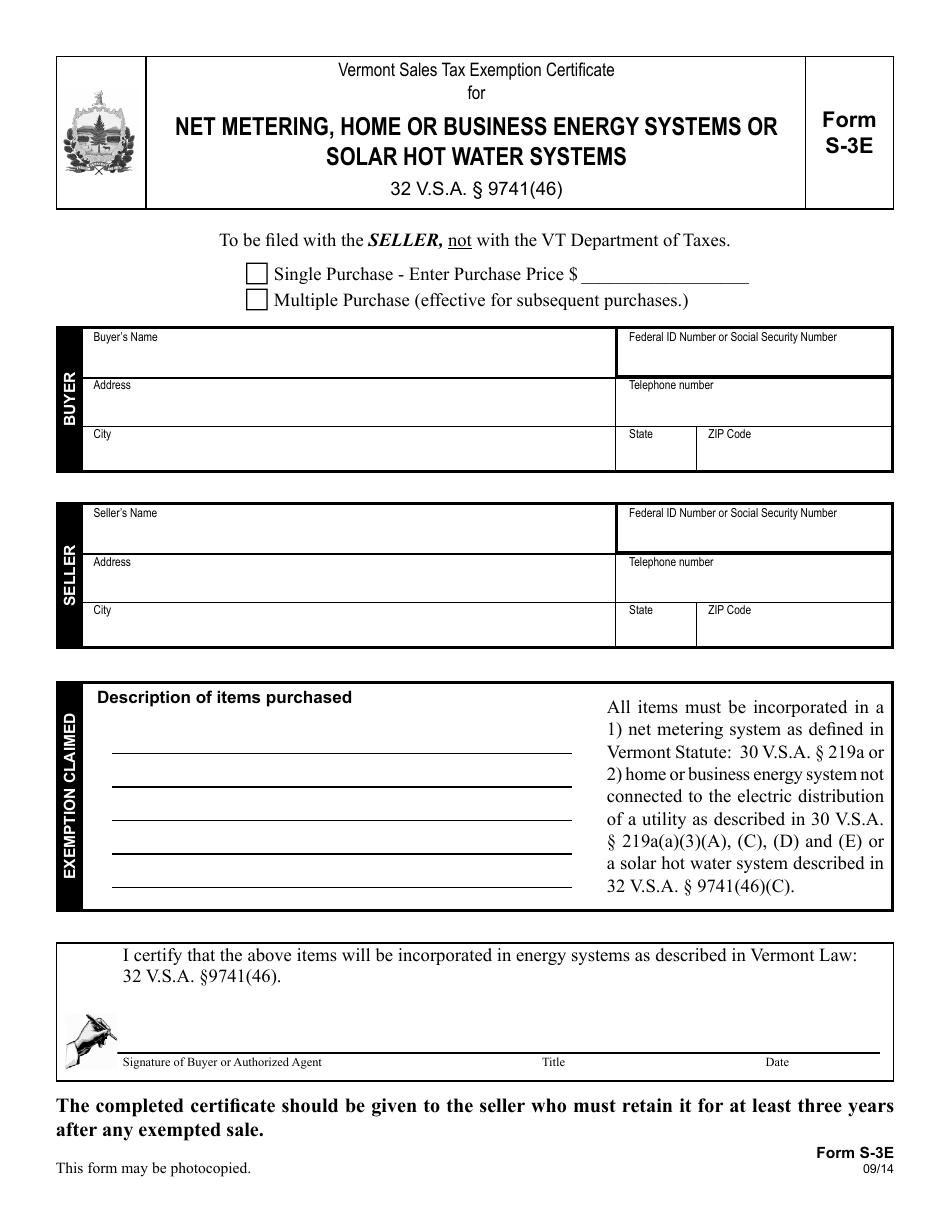

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

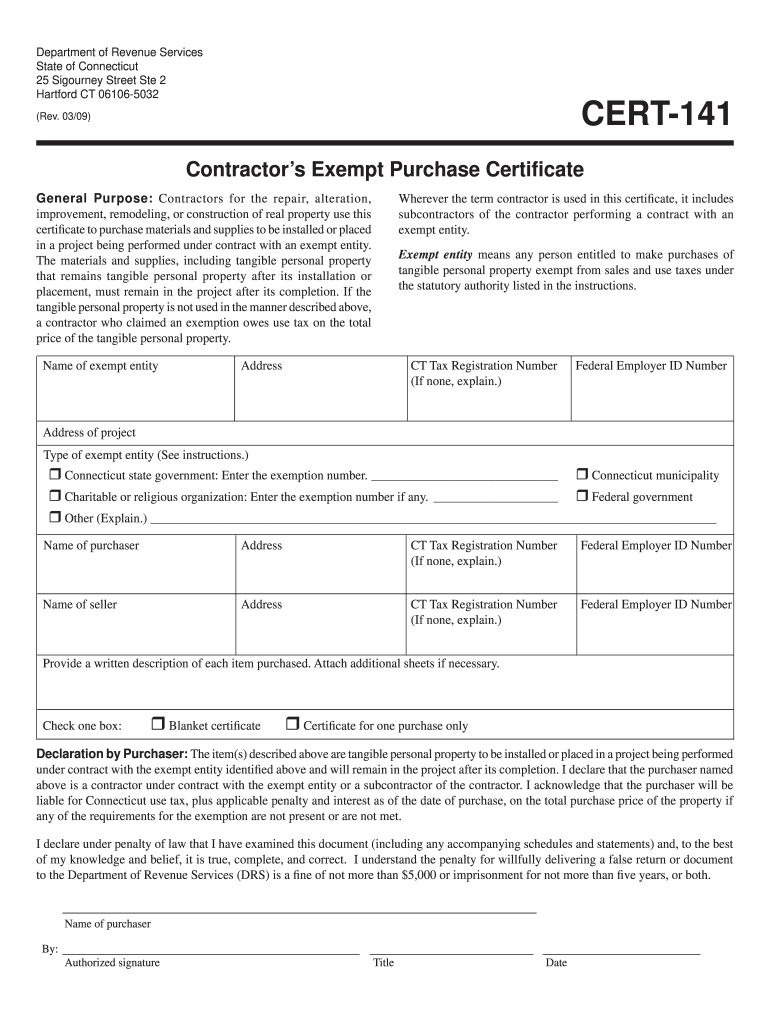

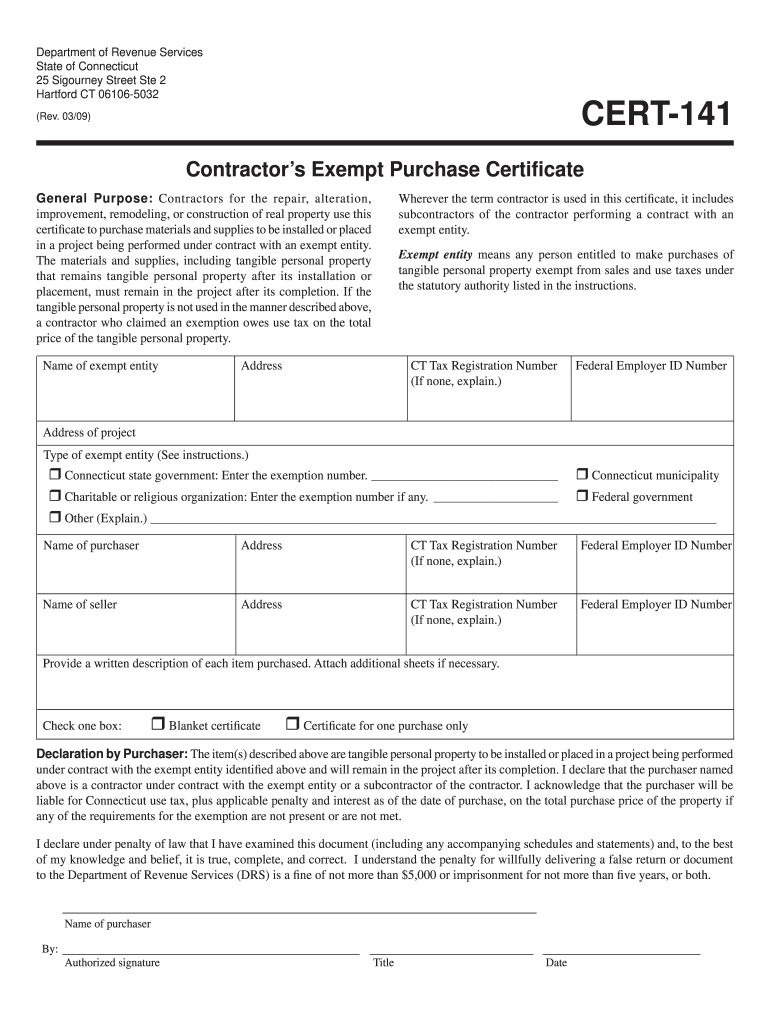

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

Application For Hospital Sales Tax Exemption Stax 300 H Pdf Fpdf Doc Docx

Fillable Standard Form 1094 15c Standard Form Fillable Forms Tax Exemption

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S

Absolute Bill Of Sale Form Bills Sale

Vermont Sales Tax Exemption Certificate For Form S

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com