vanguard tax managed balanced fund review

21 hours agoThe balanced and growth funds will charge 056 per cent a year while individual single asset options will charge the same as the default fund 058 per cent a year. Over the past decade the Vanguard Tax-Managed Balanced Fund Admiral Shares has generated an average annual rate of return of around 9.

Financial Transaction Taxes A Fact Sheet Sifma Financial Transaction Taxes A Fact Sheet Sifma

The top 10 of products in each product category receive 5 stars the next 225 receive 4 stars the next 35 receive 3 stars the next 225 receive 2 stars and the bottom.

. Incepted in December 1978 this fund is managed by Vanguard Group. VTMFX - Vanguard Tax-Managed Balanced Adm - Review the VTMFX stock price growth performance sustainability and more to help you make the best investments. See Vanguard Tax-Managed Capital App Fund VTCIX mutual fund ratings from all the top fund analysts in one place.

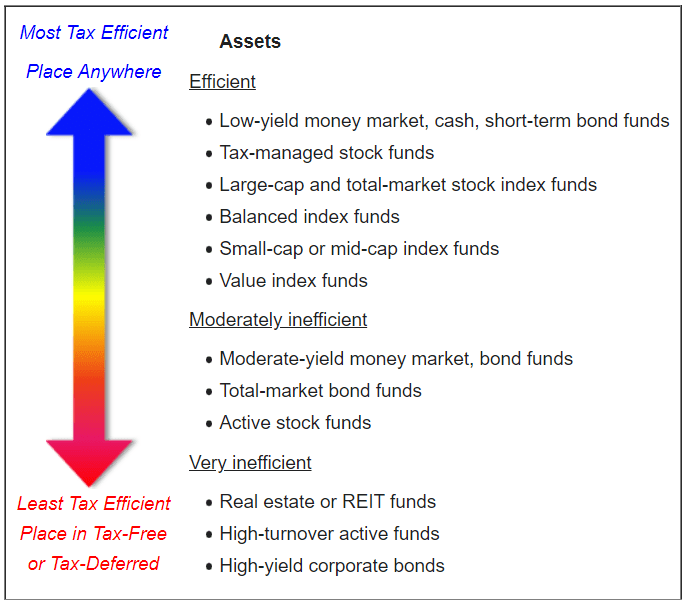

To see the profile for a specific Vanguard mutual fund ETF or 529 portfolio browse a list of all. VTMFX Performance - Review the performance history of the Vanguard Tax-Managed Balanced Adm fund to see its current status yearly returns and dividend history. While a tax-managed balanced fund is likely to be more tax-efficient than a normal all-in-one fund it is still going to be less tax-efficient than a DIY allocation for two reasons.

Review the latest Morningstar rating and analysis on the Vanguard Tax-Managed Balanced Adm fund to determine if it is the right investment decision for your goals. Vanguard mutual funds Vanguard ETFs Vanguard 529 portfolios. VTCLX - Vanguard Tax-Managed Capital App Adm - Review the VTCLX stock price growth performance sustainability and more to help you make the best investments.

Vanguard Tax-Managed Balanced Fund VTMFX Consider VTMFX to meet your needs if youre looking for a one-fund solution for your taxable account. The objective of this fund is to seek tax-efficient total return consisting of long-term growth of. The vanguard tax managed balanced fund is a balanced fund between stocks and fixed income and falls into morningstars allocation 30 to 50 percent equity category.

Vanguard Tax-Managed Balanced Adm - VTMFXBrian Williams of Northshire Consulting does a quick fund breakdownPlease subscribe to stay current with all our la. See Vanguard Tax-Managed Capital App Fund performance holdings. Without going through my entire situation just know Im aiming for overall AA of about 7525 and I just sold 30k of VBINX in taxable which was a Vanguard Balanced Fund.

The fund has a very low expense. The vanguard tax managed balanced fund is a balanced fund between stocks and fixed income and falls into morningstars allocation 30 to 50 percent equity category. The Fund seeks to provide a tax efficient investment return consisting of federally tax-exempt current income long-term capital growth and a modest.

Tax Managed Mutual Funds White Coat Investor

Vanguard Tax Managed Balanced Adm Vtmfx Fund Review Youtube

7 Best Balanced Funds To Pick Right Now Investing U S News

Which Works Best Vanguard Etfs Dfa Mutual Funds Or A Mixture Of Both Financial Planning

Build A Tax Efficient Taxable Account As A Physician Wealthkeel

Best Tax Efficient Funds Seeking Alpha

Vanguard Wellesley Income Fund 2020 Securities Registration Amendment N 1a 485bpos

Opinion The 9 Best Vanguard Funds For Retirees Marketwatch

Best Vanguard Funds For Taxable Account

8 Best Bond Funds For Retirement

Best Vanguard Mutual Funds Of November 2022 Forbes Advisor

Index Funds Vs Mutual Funds The Main Differences

7 Top Mutual Funds To Buy To Keep Taxes Low Investorplace

Seven Top Rated Allocation Funds Worth A Look Amidst A Backdrop Of Market Uncertainty Morningstar

10 Best Vanguard Index Funds You Might Want To Buy Now

Vanguard Throws In The Towel On Its Managed Payout Fund Barron S

:max_bytes(150000):strip_icc()/wealthfront-vs-vanguard-e5d87d20d839468280ff563334abc5ce.jpeg)

Wealthfront Vs Vanguard Personal Advisor Services Which Is Best For You